Institutions seek detailed blockchain analytics for crypto adoption

blockchain analytics for crypto adoption platform provides customers with a comprehensive view of the cryptocurrency market.

Blockchain analytics is the process of collecting and analyzing data from the blockchain to identify patterns and trends. It can be used to track the movement of funds, identify suspicious activity, and assess the risk of different blockchain analytics for crypto adoption assets and exchanges.

Institutional investors are increasingly interested in blockchain analytics as they look to adopt cryptocurrencies and other digital assets. This is because blockchain analytics can help them to:

- Manage risk: Blockchain analytics can help institutional investors to identify and mitigate the risks associated with investing in cryptocurrencies. For example, it can be used to identify exchanges and wallets that have been involved in hacks or other fraudulent activity.

- Comply with regulations: Financial institutions are subject to a number of regulations, including those related to anti-money laundering interview (AML) and combating the financing of terrorism (CFT). Blockchain analytics can help institutional investors to comply with these regulations by tracking the movement of funds and identifying suspicious activity.

- Make better investment decisions: Blockchain analytics can provide institutional investors with valuable insights into the cryptocurrency market. For example, it can be used to track the adoption of different cryptocurrencies, identify emerging trends, and assess the performance of different exchanges.

A leading provider of blockchain analytics solutions

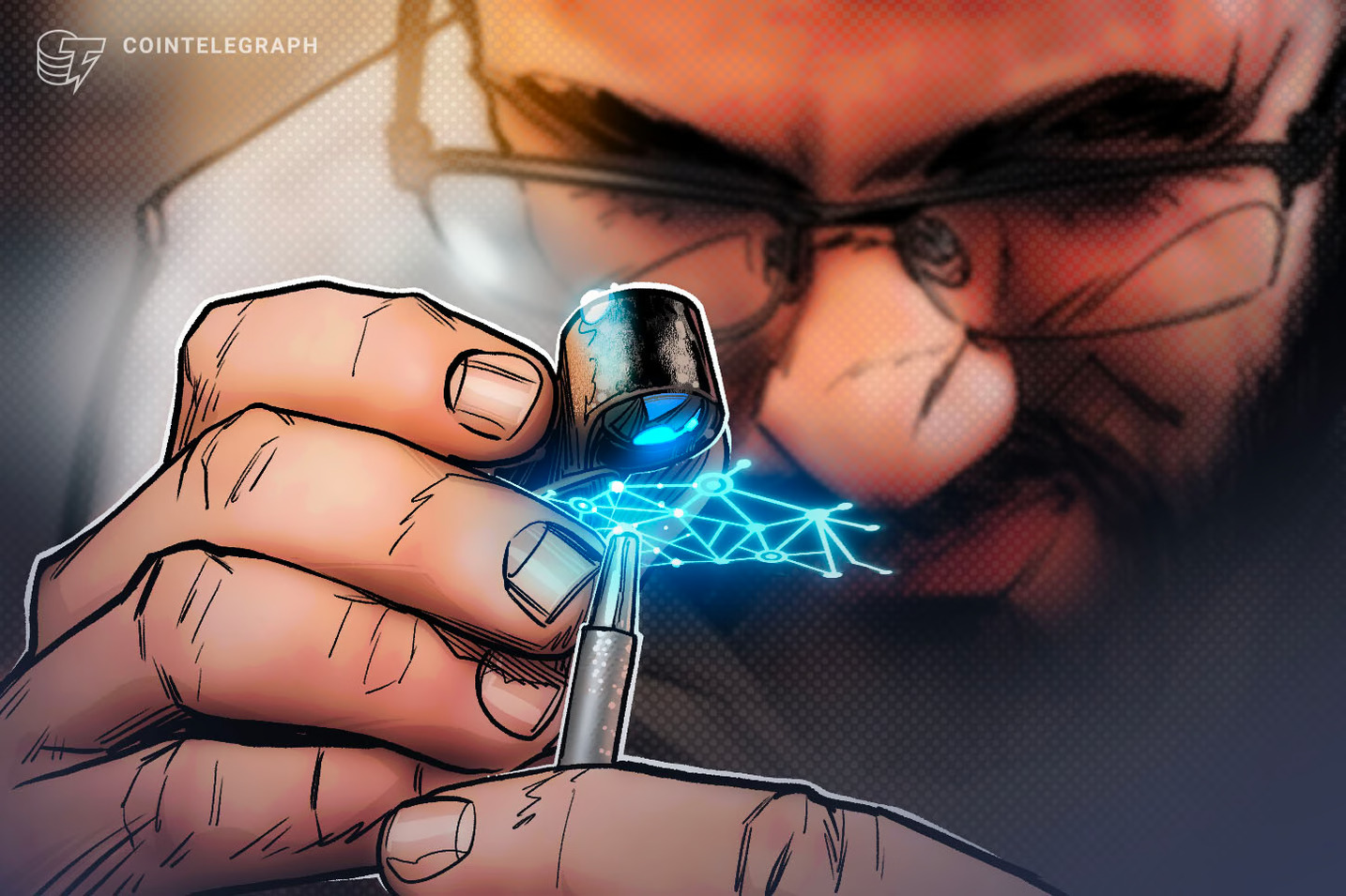

Elliptic is a leading provider of blockchain analytics solutions to financial institutions and government agencies. Elliptic's products and services help customers to identify and mitigate the risks associated with cryptocurrencies, comply with regulations, and make better investment decisions.

Elliptic's blockchain analytics platform provides customers with a comprehensive view of the cryptocurrency market. It includes data on millions of transactions and wallets, as well as insights into the latest trends and developments. Elliptic's platform can be used to identify a wide range of suspicious activity, including money laundering, terrorist financing, and fraud.

Elliptic interview products and services are used by a wide range of financial institutions, including banks, investment firms, and cryptocurrency exchanges. Elliptic's customers also include government agencies and law enforcement agencies.

How institutions are using blockchain analytics

Institutional investors are using blockchain analytics in a variety of ways. For example, some institutions use blockchain analytics to screen potential customers and transactions for suspicious activity. Others use it to monitor their own portfolios for risk. And still others use it to develop new investment products and services.

Here are a few specific examples of how institutions are using blockchain analytics:

- Banks are using blockchain analytics to screen potential customers for suspicious activity. This can help banks to avoid doing business with customers who are involved in money laundering or other illegal activities.

- Investment firms are using blockchain analytics to monitor their portfolios for risk. This can help investment firms to identify and mitigate the risks associated with investing in cryptocurrencies.

- Cryptocurrency exchanges are using blockchain analytics to detect and prevent fraud. This can help exchanges to protect their customers and maintain the integrity of their platforms.

- Government agencies are using blockchain analytics to track the movement of funds and identify suspicious activity. This can help government agencies to investigate and prosecute financial crimes.

The future of blockchain analytics

The use of blockchain analytics is expected to grow significantly in the coming years. This is due to the increasing adoption of cryptocurrencies and other digital assets by institutional investors.

As the blockchain analytics industry continues to grow, we can expect to see new and innovative products and services emerge. For example, we may see the development of blockchain analytics tools that are specifically designed for the needs of different types of financial institutions. We may also see the development of new blockchain analytics techniques that can be used to identify and mitigate new types of risks.

Blockchain analytics is a powerful tool that can help institutions to manage risk, comply with regulations, and make better investment decisions. As the adoption of cryptocurrencies and other digital assets by institutional investors continues to grow, we can expect to see the use of blockchain analytics grow significantly in the coming years.

What's Your Reaction?